ACOSS survey and the need for a revolutionary class analysis

Written by: Alan Jackson on 23 April 2024

Above: Anti-poverty activists in 2021

Everyday life is getting harder for the average person. This is disproportionately the case for First Nations people, Immigrants, Precarious workers and Pensioners, who are being impacted the hardest in these hard times.

History continues to show us that under capitalism the poor stay poor while the rich get richer. Time and time again history continues to show us this fact. The fundamental issue in this is Class.

Capitalists are constantly gutting our livelihood for profit; this is inherent to Capitalism, sometimes when the economy is booming, we are able to get concessions but it is important to remember that these are simply concessions, and inevitably as the boom goes to bust, as History also shows always must bust under capitalism, our concessions are slashed and gutted and we are back to square one.

Where are we now? How are these concessions? The Australian Council of Social Service (ACOSS) has released its report on poverty in Australia this year and highlights some very important insights into our situation.

In the Inequality Report it states “According to the latest available data (in 2019), the highest 10% of households ranked by income had an average after-tax income of $5,200 per week, over two-and-a-half times the income of the middle 20% ($2,000) and seven times that of the lowest 20% ($800).”. (1)

The gap here is extremely problematic. While the bottom 60% of Australians are struggling the highest 10% of Australians are getting up to seven times the amount of the lower 60%. This isn’t even looking at the gap within the top 10% which starts messing with amounts of money that are conceptually hard to wrap your head around.

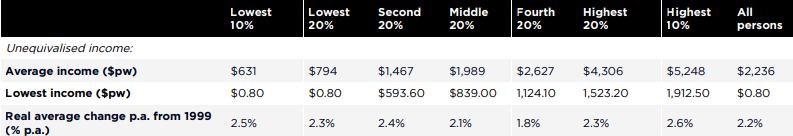

There is clearly a very large disconnect between the highest 10% and the lower 60% which can be shown in the table below. The ACOSS also found in a previous report in 2020 that “The poverty line (based on 50% of median household after-tax income) is $489 a week for a single adult and $1,027 a week for a couple with two children, based on the latest data from the ABS.” (3.) The table also says that the lowest 20% earns on average $794 per week. Therefore, the lowest 20% of Australians are on the poverty line. According to Centrelink’s own website you can only earn a maximum of $381 per week as a single person with no children and $408 per week with a child. With a partner the maximum you can earn is $349 per week. This puts most people on Centrelink benefits on the poverty line. (4.)

(2.)

The report also states that “Unequal access to employment and wages accounts for 89% of income inequality (before tax and transfers).” (5.) and that “Unequal distribution of earnings is caused by inequality of paid working hours and hourly wages.” (6.)

This shows that what is most important is everyone has access to constant and well-paid work. This can mean so much more than what you may think surface level. This means a home where one can sleep and survive, clothes you can wear to an interview, a phone you can use to contact potential employers, food and drink to function and so much more that is near impossible for the average person without these necessities to gain upward mobility.

Not having access to transport, a home or a phone is debilitating for access to employment hurting your chances even more. These things can’t be accessed on government benefits and access is generally a matter of chance. It also reports that “Wealth inequality has escalated over the past two decades, with the highest 10% - who hold an average of $5.2m in wealth capturing almost half (45%) of the overall increase in wealth between 2003 – 2022. Of this 45%, almost half (22%) went to wealthy older households (older households in the highest 10%)” (7.)

This emphatically supports the fact that the rich succeed while the poor suffer. We are in desperate need of change and the contradictions are only sharpening. This can also be shown by further statements such as “in 2019-20, the highest 10% of households ranked by income had an average $5,248 per week after tax, over two and a half times that of the middle 20% ($1,989) and six times that of the lowest 20% ($794).” (8.)

They continue, saying “Wealth is divided much more unequally than income. In 2022-23 the highest 10% of households ranked by wealth (those with over $2.5 million) held 44% of all wealth, an average of $5.2 million each. This is three times the wealth of the next 30% with $1.5 million, 15 times that of the lowest 60% with $343,000 and 126 times that of the lowest 20% (with $41,000).” (9.) and “In 2023, there were 159 billionaires in Australia with average wealth of $3.2 billion each. Their total wealth was $503 billion – so that 3.2% of all household wealth was held by 0.0007% of all adults.” (10.)

Now that some of the key issues have been highlighted, what recommendations do the ACOSS make to fix these issues? In order to fix these issues, the ACOSS has suggested a few things. The policy solutions suggested by the ACOSS are: “Increase the lowest income support payments including Jobseeker Payment and Youth Allowance; Restore full employment and reform employment services for those unemployed long-term; Reduce tax concessions for investment income (such as the reduced tax rate for capital gains) that primarily benefit those with high income.” (11.) And “Reform the tax treatment of housing to discourage speculative investment that inflates home prices (such as curbing negative gearing, reducing CGT concessions and extending state land taxes to owner occupied dwellings). Remove inequities in the tax treatment of superannuation contributions; and extend the 15% tax on superannuation investment income tax to postretirement accounts, which are currently tax-free.” (12.)

Whilst I would welcome these changes and, on the surface, these are quite commendable changes to the current situation, they are only short-term fixes and don’t address the root of the issue. The issue with the suggested fixes is that they are just concessions and can only be concessions. They can never become full-term solutions. The only solution is Socialism.

Not only are the solutions offered only just band-aid solutions, the problem is these solutions only begin to recognise the knife that is lodged in the back of the peoples. These solutions do not remove the knife and heal the wound in our back like the late and great Malcom X once said. They simply point at the knife in our back and try to wrap a bandage over it.

For immediate actions that can help take us to socialism, check out the ‘Draft Fighting Program of the Communist Party of Australia (Marxist-Leninist).’

The destruction of capitalism is the only true solution. It is only true way for the masses to heal. For a strategic approach to the destruction of capitalism, for a strategy beyond useful and necessary immediate changes, see the Party’s General Program .

Sources –

1. - Australian Council of Social Service – Inequality in Australia 2024: Who is affected and how? (Page 12)

2. – Ibid.

3. - Australian Council of Social Service – Poverty In Australia 2022 A Snapshot (page 9)

4. - https://www.servicesaustralia.gov.au/how-much-jobseeker-payment-you-can-get?context=51411

5. - Australian Council of Social Service – Inequality in Australia 2024: Who is affected and how? (Page 12)

6. – Ibid.

7. – Australian Council of Social Service – Inequality in Australia 2024: Who is affected and how? (Page 13)

8. – Ibid

9. – Ibid

10. – Ibid

11. - Australian Council of Social Service – Inequality in Australia 2024: Who is affected and how? (Page 12)

12. - Australian Council of Social Service – Inequality in Australia 2024: Who is affected and how? (Page 13)

Print Version - new window Email article

-----

Go back

Class Struggle and Socialism

Independence from Imperialism

People's Rights & Liberties

Community and Environment

Marxism Today

International

Independence from Imperialism

People's Rights & Liberties

Community and Environment

Marxism Today

International

Articles

| VALE Wallace McKitrick: cultural fighter (1950-2025) |

| Don’t leave politics to the politicians! |

| SA Government Workers in Action in Struggle Against Rising Cost of Living |

| 8th March - International Women’s Day - Salute Women’s Struggle |

| Book Review: Culture and Imperialism |

| A Capitalist Parliament Won’t Get People Out of the Mess - Mass Struggle for People’s Power the only Solution to the Crisis |

| Unions say "Don't risk Dutton" but avoid issues of substance |

| Canberra airport guards fight for job security while overseas owned security contractors compete in "race to the bottom" at privatized airports |

| Union membership and workers’ struggle |

| Woolworths Warehouse Workers' Strike Shows Strength of United Workers |

| NSW Teachers Win New Award |

| Book Review: Nature, Culture and Inequality |

| Meat…the worker! |

| Australia not so lucky country for migrant workers |

| SA Ambo’s election shows workers want their unions to fight regardless of who holds office |

| Workers' Struggle Goes Well Beyond "Protected Industrial Action" |

| "When we stand together as the working class, our victory is assured” — ‘Line in the Sand’ rally, Melbourne, 18 September. |

| All power to construction workers : CFMEU Sydney Rally |

| Support grows for CFMEU |

| CEPU exercises right-to-disconnect |

-----